The economist was reacting to the news today that the 2016 ruling by the European Commission, which ordered Ireland to collect 13 billion euro in unpaid taxes from the tech giant, was reversed.

The General Court of the European Union says the Commission was wrong to say Ireland gave state aid to Apple.

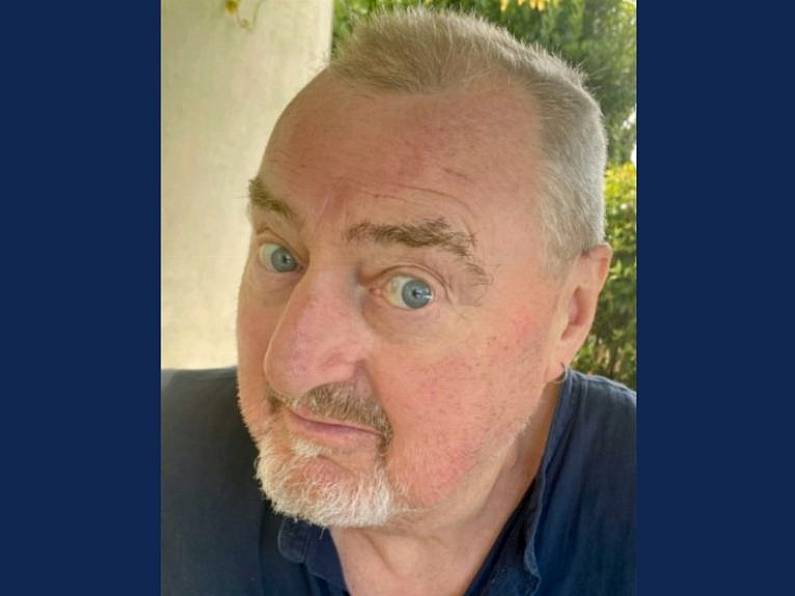

Jim Power says he thinks both Apple and the Irish government will regard today's court ruling as a victory, and that it will vindicate the Irish government's position from a foreign direct investment perspective, that it does not engage in unfair tax treatment.

However, Mr Power added the caveat that this ruling is likely to be appealed with the European Court of Justice.

He also believes that there will be growing global pressure over the coming years to make sure companies pay corporation tax in the country where the economic activity actually occurs, rather than in the country where its balance sheet resides. Jim Powers says in this regard, countries like Ireland and The Netherlands are deemed to be engaging in tax practices that not everyone agrees with. He feels this 'saga' is far from over.