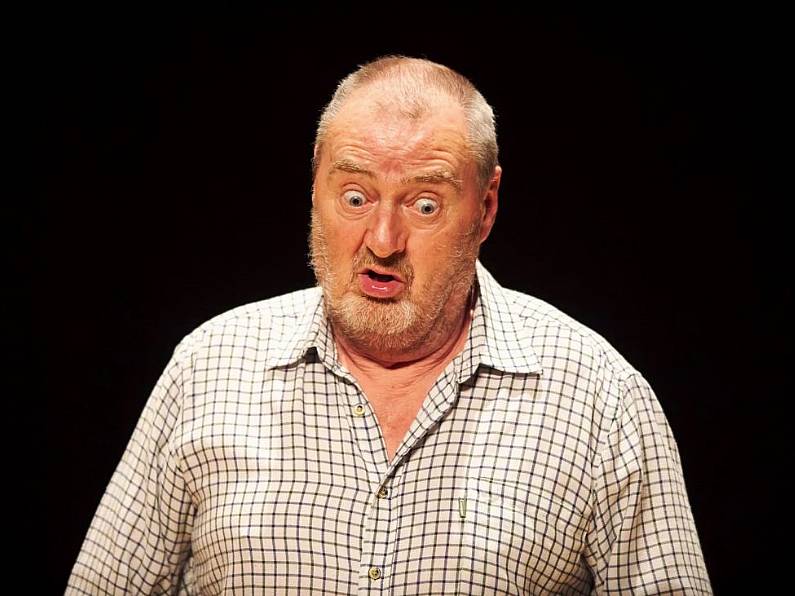

A Waterford Senator says he has been paying higher car insurance premiums for the past six years.

John Cummins says people with outstanding claims are being penalised by insurance companies.

The Central Bank interim report has highlighted the importance of shopping around after it found loyal customers were paying the most.

John Cummins says that he wanted to focus on one group of people, "especially in light of the findings that loyalty premiums and price walking were evident, whereby insurance premiums increase incrementally each year for existing customers at renewal time".

He told the Seanad that: "The consumers in question are those with outstanding claims who are essentially tied to their existing insurer until such time as a claim is settled or goes through the court system.

"I am one such person. Only two weeks ago, I had an outstanding claim against my insurance company determined in the High Court after nearly six years, which the judge dismissed, just as a Circuit Court judge had done two years ago."

Senator Cummins says he cannot fault his own insurance provider.

"It defended the claim at significant cost and rightly so. However, as I had an outstanding claim, I was not able to shop around the market as any regular person could. Accordingly, over the past six years, I have been paying higher insurance premiums."

He added that he is not alone in that regard. "It is an issue that needs to be addressed as part of the wider reform agenda to which the Government is committed."