Middle earners who earn less than the average working wage but who pay the top rate of tax may be moved to a lower third rate of income tax, under plans being developed by the Government.

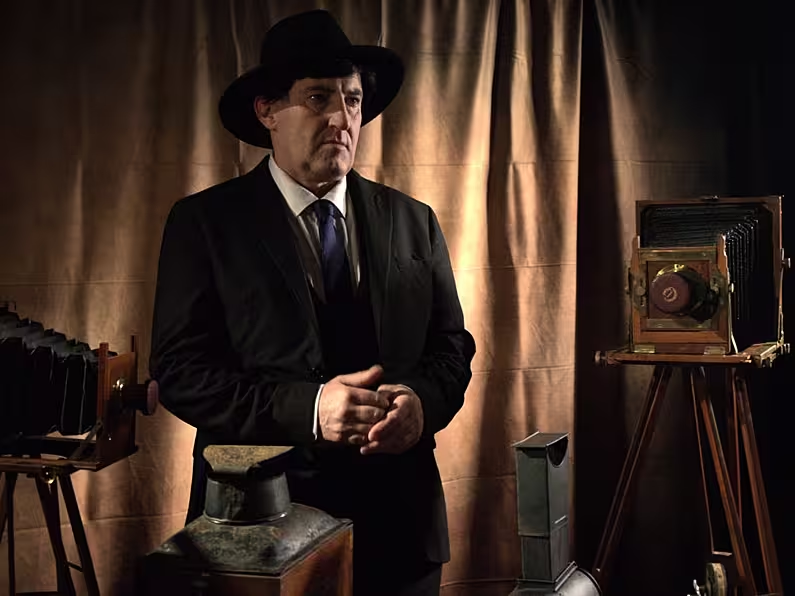

Junior Finance Minister Michael D’Arcy, in his first major interview since taking office, has said the squeezed middle have to be given a break in terms of how much tax they pay.

Speaking to the Irish Examiner, Mr D’Arcy said that a third middle rate of tax is being considered.

He said: “People accept at this stage the people in the working middle need to get something back.

“So what we now have to do is to help people who are in that mid range in pay. We have to do something there. Both the Taoiseach and Paschal Donohoe, the finance minister are extremely eager to do something there.”

Mr D’Arcy outlined a possible third rate of income tax which is between the top marginal rate of 40% which is paid on all incomes above €33,800 and the lower standard rate of 20%.

“There is a train of thought that there should be a third middle rate of tax between the two rates at a lower space. We have to reduce the burden of income tax on those people,” he said. “The entry point to the higher rate is damaging,” he added.

Mr D’Arcy said the fact that in Ireland you can still earn less than the average industrial wage and be forced to pay the top rate of tax is damaging job creation.

“It is really unusual that you would pay the higher rate of tax before you earn the average industrial wage. That doesn’t happen elsewhere. Scope this year is limited so this is over a number of years,” he said.

At present, a single person working begins to pay the top rate of tax at €33,800 or up to €67,600 for a married couple where both work.

Yet, according to the CSO Yearbook Of Ireland 2016, the average wage is €45,075 for someone working full-time.

Mr D’Arcy also said that a “welfare dependency” culture exists in some parts in Ireland, which he said has caused “chaos” by allowing people feel they are better off on welfare than in work.

“There has been the poverty traps which were causing chaos. People were annoyed that some were better off not working,” he said.

However, he said much has been done by Fine Gael to eradicate such traps saying that the Government’s clear strategy is to make work pay.

“Yes, there have been too many welfare benefits and that is why we have changed things around, so people who got back into the workforce were allowed keep their medical cards for a while.

Mr D’Arcy also hinted that a number of health related taxes could be introduced or increased as a means of raising revenue to afford such tax breaks.

He mentioned the possibility of a sugar tax and also said he wants to tackle the issue of low-cost alcohol in supermarkets, which he said is causing major damage.

“I am going to be doing something hard on the supermarkets if possible on off-licence sales. But in my view, what we need to do is target where the damage is being done, and that is where the slabs of beer are stacked ten feet high inside the door of the supermarkets. That is where the mischief is,” he added.

This article first appeared in the Irish Examiner.