The average cost of running a car in Ireland is more than €10,500 per year, according to the AA.

New figures from the AA show it is a slight drop on 2016 figures of around 10%.

A number of factors contribute to the high costs, including car insurance, taxation and fuel costs.

They said that stable fuel prices along with a 10.2% drop in car insurance prices are the key factors in the declining cost which dropped €178.05 from last year to €10,671.37 in 2017.

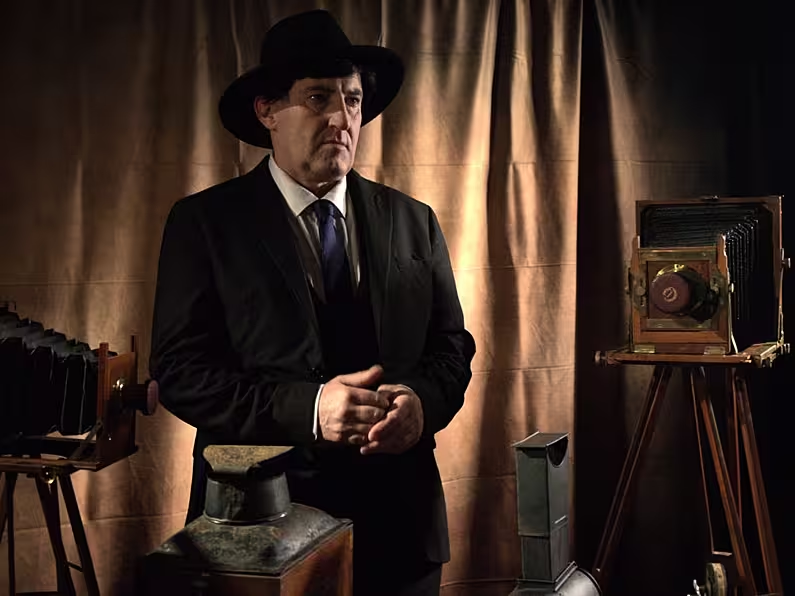

The AA's Director of Consumer Affairs, Conor Faughnan, said: "Motorists renew their motor insurance once per year so depending on when you pay you may not have seen any fall off in the cost yet.

"The best we can say is that when we compare August of this year to August of last the cost did not get any worse overall."

The AA also warned that a year-on-year measure does not factor in the "very hefty" price increases that came along more than 12 months ago.

Motorists saw prices jump in a short period of time between 2014 and 2016 and they have remained high since.

Mr Faughnan said: "Rising motor insurance premiums have been the main issue faced by motorists for over two years now, and something which the AA has highlighted to government since the publication of our five-point plan to tackle rising insurance costs in November 2015.

"While it appears some progress is being made in this space, in order for the trend to continue into the future and for motorists to ultimately start seeing their premiums drop it’s important that government continues to give this issue the attention it deserves."

Mr Faughnan outlined some things motorists can do to lower their costs.

He said: "If you have a spouse or partner then adding them to your insurance policy, as long as they have a clean driver record, can net you a discount of up to 20% and separately it’s always worth shopping around.

"Even if you receive a renewal quote which seems competitive call your current insurer and others to see if anyone can do better for you."